See This Report about Guided Wealth Management

See This Report about Guided Wealth Management

Blog Article

Guided Wealth Management Fundamentals Explained

Table of Contents3 Easy Facts About Guided Wealth Management ShownNot known Details About Guided Wealth Management Getting The Guided Wealth Management To WorkFascination About Guided Wealth ManagementThe Definitive Guide to Guided Wealth Management

For even more suggestions, see monitor your financial investments. For investments, make repayments payable to the product company (not your advisor) (financial advisor brisbane). Consistently inspect deals if you have an investment account or use an financial investment platform. Offering a monetary adviser full access to your account enhances threat. If you see anything that doesn't look right, there are actions you can take.If you're paying an ongoing advice cost, your advisor should review your financial situation and satisfy with you at least as soon as a year. At this meeting, make sure you review: any type of modifications to your goals, circumstance or finances (including adjustments to your income, expenditures or possessions) whether the degree of risk you fit with has actually transformed whether your current personal insurance cover is best just how you're tracking against your goals whether any type of changes to legislations or economic products could impact you whether you have actually received everything they guaranteed in your agreement with them whether you require any adjustments to your plan Every year an advisor must seek your composed grant bill you ongoing suggestions charges.

If you're moving to a new advisor, you'll need to organize to move your economic documents to them. If you require aid, ask your consultant to explain the procedure.

The Single Strategy To Use For Guided Wealth Management

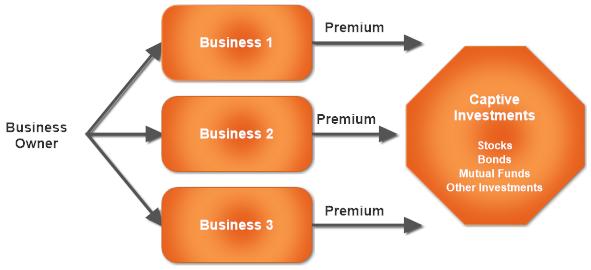

As a business owner or tiny organization owner, you have a great deal going on. There are many responsibilities and expenditures in running a business and you certainly do not require an additional unnecessary bill to pay. You need to carefully take into consideration the roi of any services you reach ensure they are rewarding to you and your organization.

If you're one of them, you might be taking a substantial danger for the future of your service and yourself. You might wish to keep reading for a listing of factors why employing an economic consultant is useful to you and your organization. Running a company has lots of obstacles.

Cash mismanagement, capital problems, delinquent payments, tax obligation problems and various other monetary issues can be crucial enough to shut an organization down. That's why it's so essential to manage the economic aspects of your company. Employing a respectable economic expert can prevent your service from going under. There are many ways that a qualified economic expert can be your partner in assisting your organization flourish.

They can deal with you in assessing your economic scenario often to stop severe errors and to rapidly correct any kind of negative cash decisions. Most tiny service owners wear many hats. It's understandable that you wish to conserve cash by doing some tasks yourself, but handling financial resources takes knowledge and training.

Some Ideas on Guided Wealth Management You Should Know

You require it to understand where you're going, just how you're getting there, and what to do if there are bumps in the road. An excellent economic advisor can place together a comprehensive strategy to help you run your service more successfully and prepare for anomalies that occur.

A respectable and experienced monetary consultant can assist you on the financial investments that are appropriate for your organization. Cash Cost savings Although you'll be paying a monetary expert, the lasting savings will certainly warrant the cost.

It's all about making the wisest monetary choices to increase your chances of success. They can assist you toward the best opportunities to enhance your earnings. Lowered Tension As a local business owner, you have great deals of things to stress over (superannuation advice brisbane). An excellent economic advisor can bring you peace of mind understanding that your funds are obtaining the attention they require and your money is being invested intelligently.

Guided Wealth Management Things To Know Before You Get This

Security and Development A competent economic advisor can offer you clarity and aid you concentrate on taking your business in the best direction. They have the devices and resources to utilize methods that will ensure your company grows and prospers. They can aid you assess your goals and figure out the ideal course to reach them.

Guided Wealth Management - Truths

At next Nolan Accounting Facility, we offer knowledge in all elements of financial planning for small companies. As a small service ourselves, we understand the obstacles you face every day. Offer us a call today to review exactly how we can aid your company prosper and succeed.

Independent ownership of the technique Independent control of the AFSL; and Independent pay, from the customer only, through a set buck fee. (https://www.reverbnation.com/artist/guidedwealthm)

There are many benefits of a monetary planner, despite your scenario. Yet regardless of this it's not unusual for people to second hunch their viability because of their position or current financial investments. The objective of this blog is to prove why every person can profit from a monetary plan. Some common concerns you might have felt yourself include: Whilst it is very easy to see why individuals might assume by doing this, it is absolutely wrong to consider them remedy.

Report this page